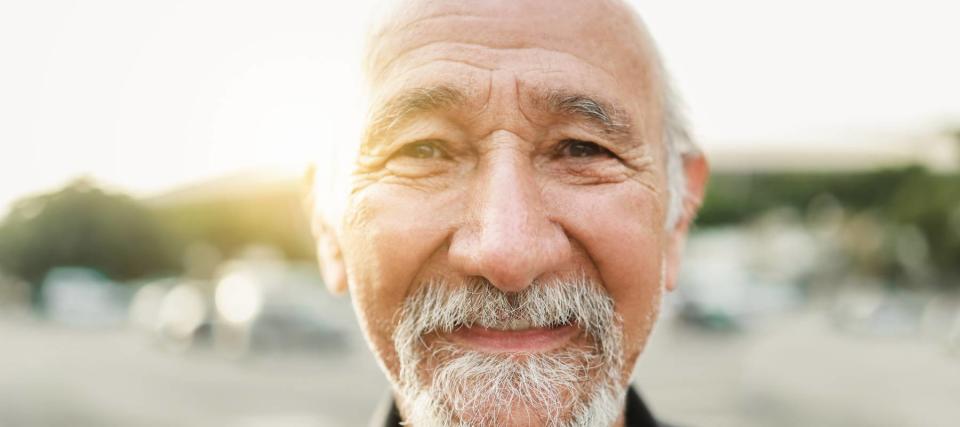

Man, 62, happy living on $2,600 a month from Social Security and part-time job — with zero retirement savings

Not everyone needs a giant nest egg to enjoy their golden years.

George Dziamniski of Finleyville, Pennsylvania, seems to be doing just fine on a modest income of $2,600 a month. About $1,000 of that comes from Social Security, while the remaining $1,600 is earned from his job at Walmart, where he works two to three days a week.

Don’t miss

-

Commercial real estate has beaten the stock market for 25 years — but only the super rich could buy in. Here’s how even ordinary investors can become the landlord of Walmart, Whole Foods or Kroger

-

Car insurance premiums in America are through the roof — and only getting worse. But 5 minutes could have you paying as little as $29/month

-

These 5 magic money moves will boost you up America’s net worth ladder in 2024 — and you can complete each step within minutes. Here’s how

The 62-year-old is able to cover the essentials — an apartment, groceries and a phone — and once in a while he’ll spend extra money on books.

Apart from a few thousand dollars stashed away in case of an emergency, Dziamniski says he has no retirement savings. He’s a man who lives within his means.

“If I had $1 million, I don’t know what I would do with it,” he told Business Insider in a story published on July 14.

And that begs an interesting question. Are U.S. workers putting undue pressure on themselves to save for retirement? Or is it smart to push for a high-value nest egg?

Will you need less income than you think?

The average American aged 55 to 64 spends $78,079 a year, per the Bureau of Labor Statistics. But that number drops to $57,818 among Americans aged 65 and older.

Meanwhile, as of June, the average person receiving Social Security retirement benefits collects about $23,000 per year. Getting to $57,818 in spending requires about $35,000 in non-Social Security income. And while not all of that has to come from savings, for those who don’t want to work in their golden years or don’t have a pension, it’s easy to make the case for needing a $1 million nest egg — or close to it.

If we follow the popular 4% rule, it would take $875,000 in savings to allow for $35,000 (adjusted for inflation) in annual withdrawals. If we assume a more conservative withdrawal rate of 3.5%, $1 million would be the magic number. So, unless you’re planning to lead a very frugal lifestyle, you may, in fact, need a $1 million nest egg to cover your expenses without worry.

Read more: Car insurance rates have spiked in the US to a stunning $2,150/year — but you can be smarter than that. Here’s how you can save yourself as much as $820 annually in minutes (it’s 100% free)

But if you’re someone who makes the most out of every dollar, you may be able to get away with saving much less. Dziamniski doesn’t own a car and relies on rides and public transportation. He also doesn’t take vacations, and by his account, he’s fine with all of that.

If you feel similarly, you may not need as much savings as you initially thought. That being said, it’s important to be honest with yourself about what you want your golden years to look like.

Make sure you have a backup plan

Dziamniski’s financial situation might work for him now, but his limited savings could put him in a serious bind if something were to happen and he needed more cash on hand than what he has in his emergency fund.

His job also represents more than half of his income. At some point, he may not be able to keep doing that work, leaving him with just a monthly Social Security check. His current $1,000 benefit should increase through the years thanks to the program’s automatic cost-of-living adjustments, but those increases may not be enough to cover his expenses.

The poverty threshold for a single person under the age of 65 was $15,852 per year in 2023 and $14,614 for those aged 65 and over, per the Census Bureau. Dziamniski risks plunging below these levels if his work hours are severely cut back or he ends up having to leave his job entirely.

That’s why it’s important to have some savings and not just rely on Social Security and income from a part-time job. Health issues or an economic downturn could be detrimental to your finances. And while lawmakers have never allowed Social Security to cut benefits in the past, that’s a possibility in about a decade’s time due to an impending financial shortfall.

You don’t necessarily have to push yourself to save $1 million or more, but it’s a good idea to create a budget that outlines your essential needs and costs at this point in your life.

From there, you can get an estimate of your monthly Social Security benefit and figure out how much savings you need to make up the difference each year.

If, like Dziamniski, you plan to live modestly and whittle down your budget by cutting any unnecessary expenses, you may not require as much savings. But if you think you’ll want to go on adventures and travel a bit, or you want extra money so you don’t have to stress about things like home repairs, aim a bit higher. And it’s definitely worth sitting down with a financial adviser for some help setting a savings goal rather than go through the process alone.

What to read next

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.

Post Comment