Nvidia passes Apple in market cap

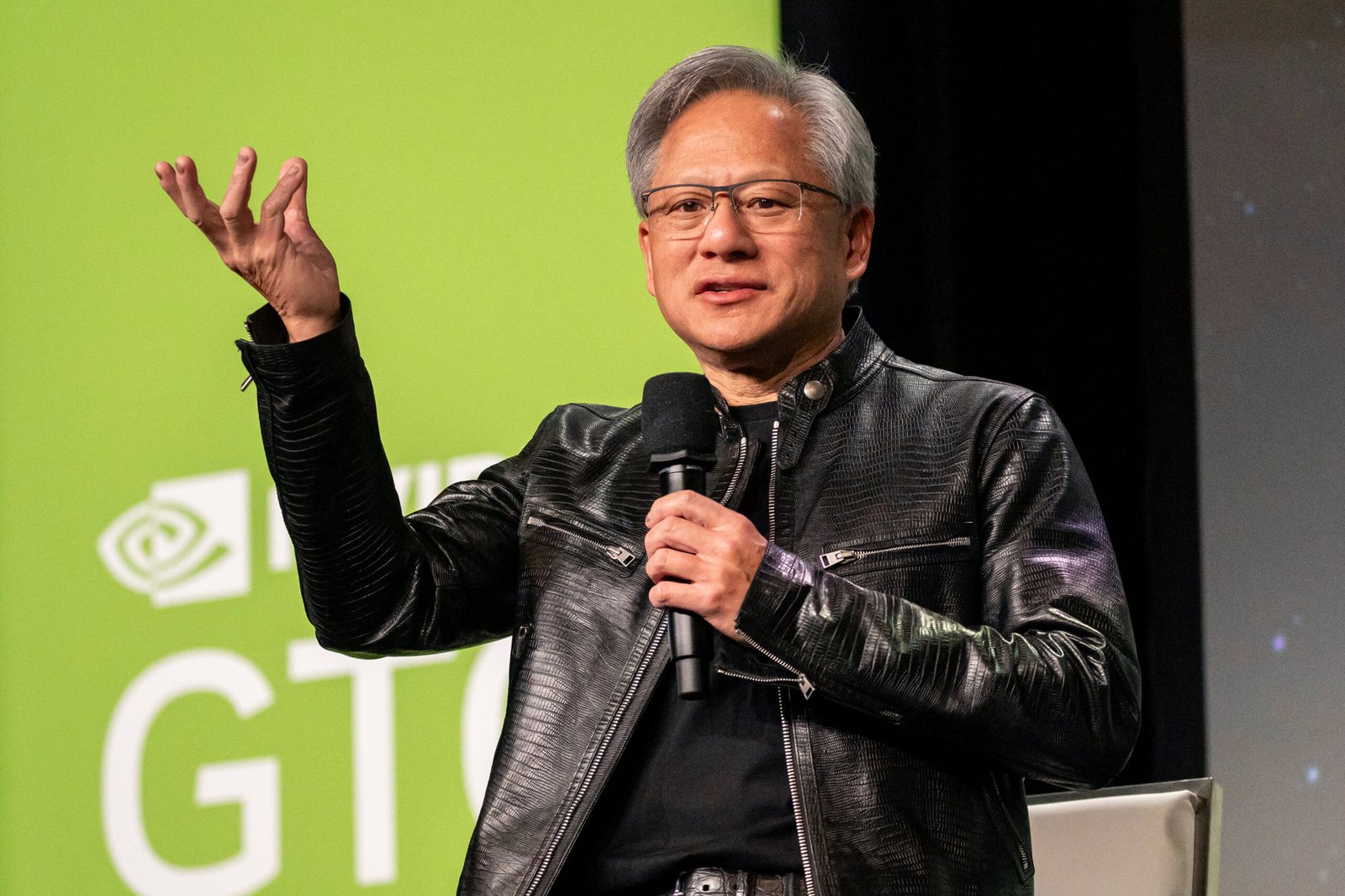

Jensen Huang, co-founder and CEO of Nvidia, during the Nvidia GPU Technology Conference in San Jose, California, on March 19, 2024.

David Paul Morris | Bloomberg | Getty Images

Nvidia passed Apple in market cap on Wednesday as investors continue betting on the chipmaker behind the artificial intelligence boom. It is now the second-most valuable public company, behind Microsoft.

Nvidia also hit a $3 trillion market cap milestone on Wednesday after shares rose over 5%. At market close, Nvidia had a market value of $3.019 trillion, versus Apple’s, which stood at $2.99 trillion. Microsoft is the most valuable publicly traded company, with a market cap of $3.15 trillion, as of Wednesday.

Nvidia shares have risen more than 24% since the company reported first-quarter earnings in May and have been on a tear since last year. The company has an estimated 80% market share in AI chips for data centers, which are attracting billions of dollars in spending from big cloud vendors.

Investors are also becoming more comfortable that Nvidia’s huge growth in sales to a handful of cloud companies can persist. For the most recent quarter, revenue in its data center business, which includes its GPU sales, rose 427% from a year earlier to $22.6 billion, about 86% of the company’s overall sales.

Meanwhile, Apple shares are up only about 5% this year, as the iPhone maker’s sales growth has stalled in recent months. In its most recent quarterly earnings report, Apple said overall sales dropped 4% and iPhone sales fell 10% from the year-ago period. Apple faces strategic questions and issues about demand in China, manufacturing and mixed reactions to its new virtual reality headset, Vision Pro.

Apple was the first company to reach a $1 trillion and $2 trillion market cap. It long held the title of most valuable U.S. company but was passed by Microsoft earlier this year. Microsoft has also benefited from investor demand for AI infrastructure.

Nvidia has been more volatile as a stock than Apple. Founded in 1991, the company was primarily targeting gaming, selling hardware to play 3D computer games. More recently, it sold cryptocurrency mining chips and cloud subscription services.

Nvidia shares have gone parabolic as its AI business has developed, rising more than 3,290% over the past five years. The company announced a 10-for-1 stock split in May.

Post Comment