Fast-Growing $2 Trillion Private Credit Market Warrants Closer Watch

The private credit market, in which specialized non-bank financial

institutions such as investment funds lend to corporate borrowers, topped

$2.1 trillion globally last year in assets and committed capital. About

three-quarters of this was in the United States, where its market share is

nearing that of syndicated loans and high-yield bonds.

This market emerged about three decades ago as a financing source for

companies too large or risky for commercial banks and too small to raise

debt in public markets. In the past few years, it has grown rapidly as

features such as, speed, flexibility, and attentiveness have proved valuable

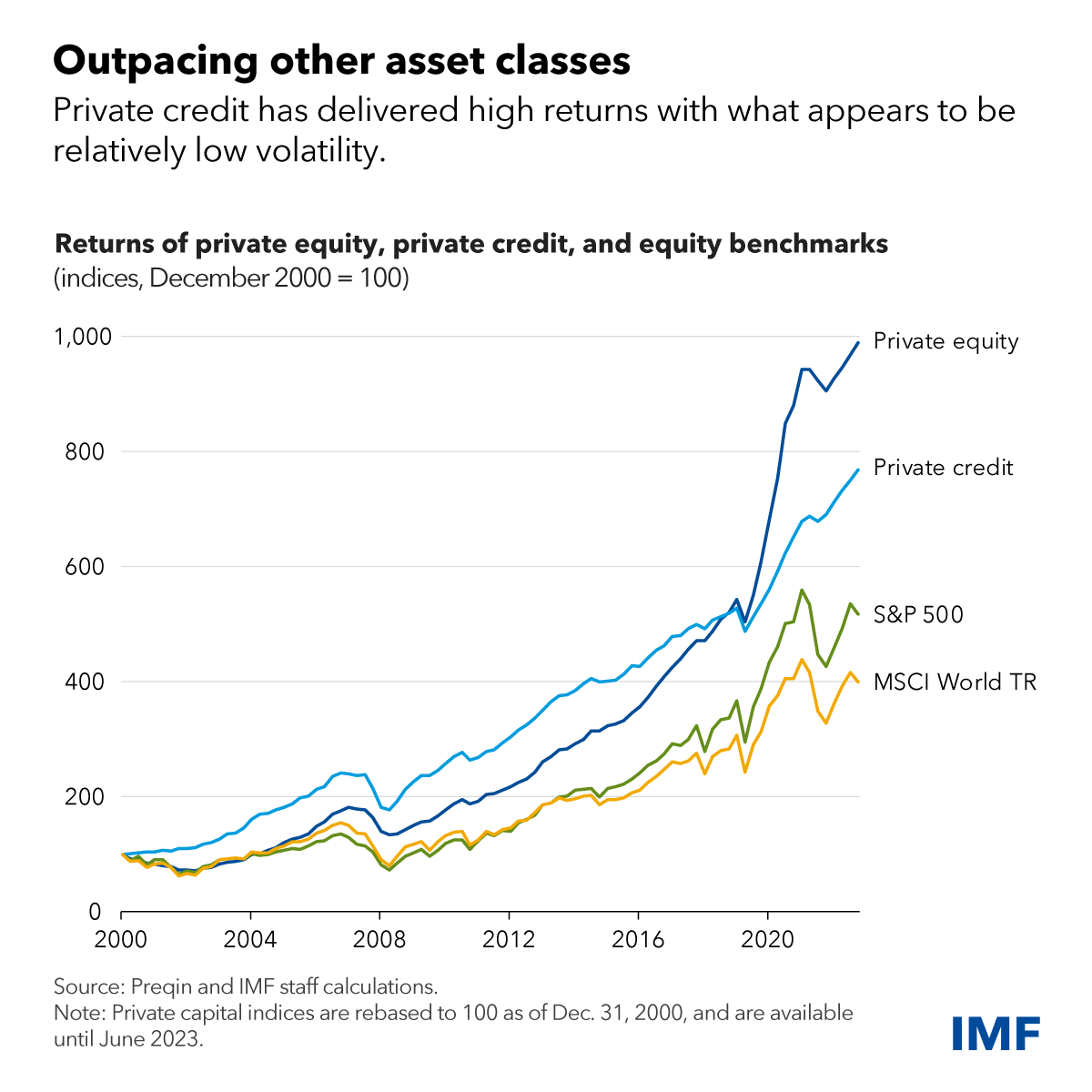

to borrowers. Institutional investors such as pension funds and insurance

companies have eagerly invested in funds that, though illiquid, offered

higher returns and less volatility.

Private corporate credit has created significant economic benefits by

providing long-term financing to corporate borrowers. However, the migration

of this lending from regulated banks and more transparent public markets to

the more opaque world of private credit creates potential risks. Valuation

is infrequent, credit quality isn’t always clear or easy to assess, and it’s

hard to understand how systemic risks may be building given the less than

clear interconnections between private credit funds, private equity firms,

commercial banks, and investors.

Today, immediate financial stability risks from private credit appear to be

limited. However, given that this ecosystem is opaque and highly

interconnected, and if fast growth continues with limited oversight,

existing vulnerabilities could become a systemic risk for the broader

financial system.

We identify a number of fragilities in our April 2024 Global Financial Stability Report.

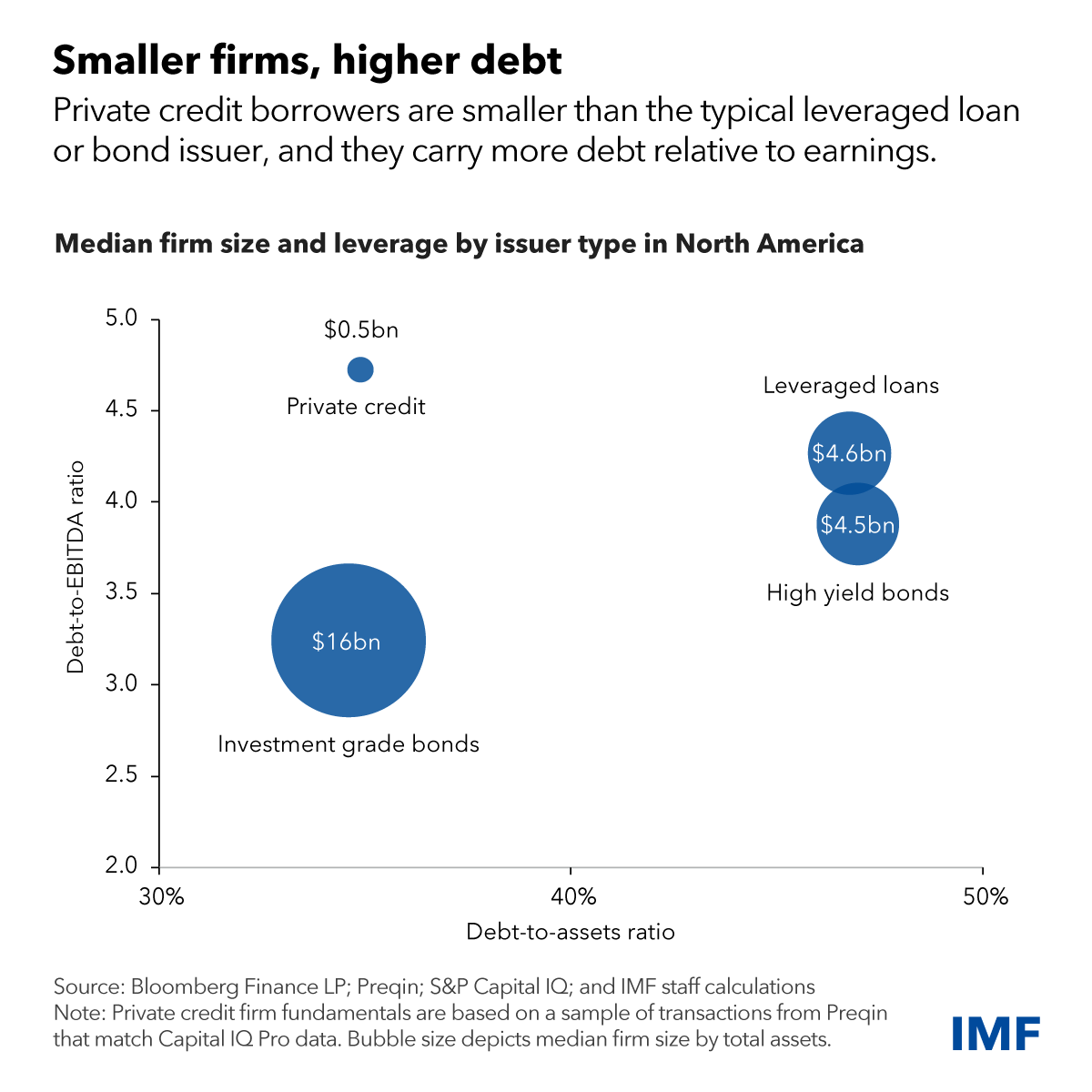

First, companies that tap the private credit market tend to be smaller

and carry more debt than their counterparts with leveraged loans or

public bonds. This makes them more vulnerable to rising rates and

economic downturns. With the recent rise in benchmark interest rates,

our analysis indicates that more than one-third of borrowers now have

interest costs exceeding their current earnings.

The rapid growth of private credit has recently spurred increased

competition from banks on large transactions. This in turn has put pressure

on private credit providers to deploy capital, leading to weaker

underwriting standards and looser loan covenants—some signs of which have

already been noted by supervisory authorities.

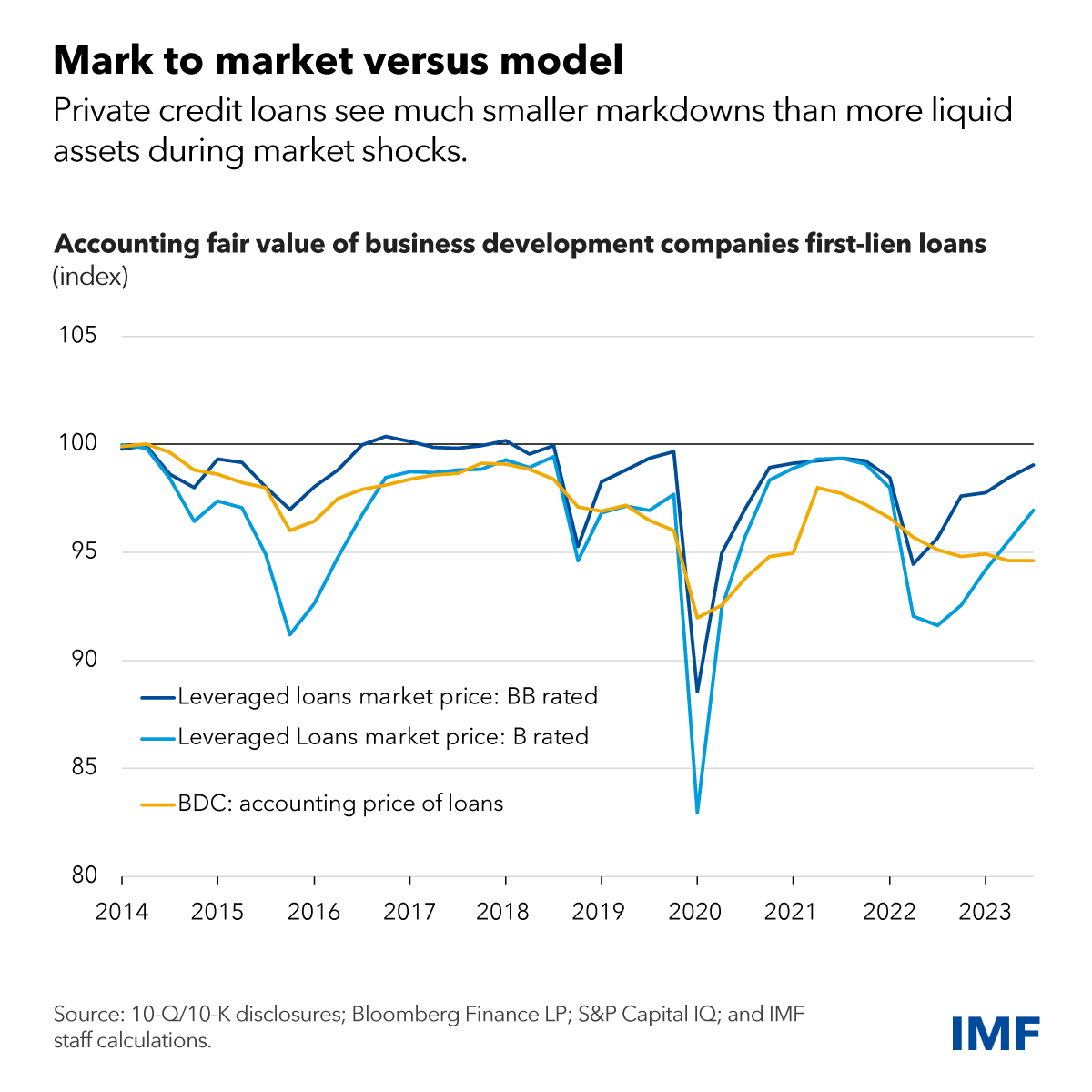

Second, private market loans rarely trade, and therefore can’t be valued

using market prices. Instead, they are often marked only quarterly using

risk models, and may suffer from stale and subjective valuations across

funds. Our analysis comparing private credit to leveraged loans (which trade

regularly in a more liquid and transparent market) shows that, despite

having lower credit quality, private credit assets tend to have smaller

markdowns during times of stress.

Third, while private credit fund leverage appears to be low, the potential

for multiple layers of hidden leverage within the private credit ecosystem

does raise concerns given the lack of data. Leverage is deployed also by

investors in these funds and by the borrowers themselves. This layering of

leverage makes it difficult to assess potential systemic vulnerabilities of

this market.

Fourth, there appears to be a significant degree of interconnectedness in

the private credit ecosystem. While banks do not seem to have a material

exposure to private credit in aggregate—the Federal Reserve has

estimated that US private credit borrowing amounted to less than about $200 billion,

less than 1 percent of US bank assets—some banks may have concentrated

exposures to the sector. In addition, a select group of pension funds and

insurers are diving deeper into private credit waters, significantly upping

their share of these less-liquid assets. This includes

private-equity-influenced life insurance companies, as we discussed in a

recent report.

Finally, though liquidity risks appear limited today, a growing retail

presence may alter this assessment. Private credit funds use long-term

capital lockups and impose constraints on investor redemptions to align the

investment horizon with the underlying illiquid assets. But new funds

targeted at individual investors may have higher redemption risks. Although

these risks are mitigated by liquidity management tools (such as gates and

fixed redemption periods), they have not been tested in a severe runoff

scenario.

Overall, although these vulnerabilities currently do not pose a

systemic risk to the broader financial sector, they may continue to build,

with implications for the economy. In a severe downturn, credit quality

could deteriorate sharply, spurring defaults and significant losses. Opacity

could make these losses hard to assess. Banks could curb lending to private

credit funds, retail funds could face large redemptions, and private credit

funds and their institutional investors could experience liquidity strains.

Significant interconnectedness could affect public markets, as insurance

companies and pension funds may be forced to sell more liquid assets.

The cumulative effect of these links may have significant economic

implications should stress in private credit markets result in a pullback

from lending to companies. Severe data gaps make monitoring these

vulnerabilities across financial markets and institutions more difficult and

may delay proper risk assessment by policymakers and investors.

Policy implications

It is imperative to adopt a more vigilant regulatory and supervisory posture

to monitor and assess risks in this market.

-

Authorities should consider a more active supervisory and regulatory

approach to private credit, focusing on monitoring and risk management,

leverage, interconnectedness, and concentration of exposures. -

Authorities should enhance cooperation across industries and national

borders to address data gaps and make risk assessments more consistent

across financial sectors. -

Regulators should improve reporting standards and data collection to

better monitor private credit’s growth and its implications for

financial stability. -

Securities regulators should pay close attention to liquidity and

conduct risk in private credit funds, especially retail, that may face

higher redemption risks. Regulators should implement

recommendations on product design and liquidity management from the Financial Stability

Board and the International Organization of Securities Commissions.

—This blog is based on Chapter 2 of the April 2024 Global Financial

Stability Report: “The Rise and Risks of Private Credit.”

Post Comment