Performing Credit Quarterly 2Q2024: The Dual Economy

Conflicting trends in a bifurcated U.S. economy are creating challenges for central bankers trying to determine their next move and investors determining where to allocate their next dollar. On one hand, the stock market continues to reach unprecedented heights, with more companies now sporting market caps exceeding $1 trillion. As the wealthy have seen their asset bases expand in the last year, they’ve increased their investment activities by participating in both traditional and nascent markets, which has put upward pressure on prices in most asset classes. On the other hand, consumers lower down the income ladder are facing mounting challenges due to high interest rates and the elevated cost of basic goods. Importantly, the excess savings that this latter group accumulated during the pandemic has mostly been depleted, even as the wealth of those in the highest income deciles continues to grow.

What does this mean for credit markets? This concentration of wealth has caused capital markets to be far more generous than would be expected in an elevated interest rate environment. As a result, many highly levered companies have been able to postpone potential problems by refinancing their debt.

But the mixed signals the Federal Reserve is receiving – e.g., booming financial markets, low but rising unemployment, and declining but still elevated inflation – make it unlikely that the central bank will cut interest rates aggressively in the near term. If interest rates stay well above their ten-year average for an extended period of time and pockets of the economy weaken, companies with unstable capital structures may find it increasingly challenging to keep kicking the can down the proverbial road. Thus, we believe credit investors should proceed with caution and avoid assuming that major concerns about corporate credit are all in the rearview mirror.

A Tale of Two Consumers

At a time when aggregate U.S. economic data is mostly positive and financial markets are booming, one might expect consumer confidence to be increasing. But this isn’t the case. Only one-third of consumers maintain a positive outlook on the U.S. economy, primarily due to concerns relating to the high cost of many essential goods.1 This figure is down roughly five percentage points since February. In the most recent University of Michigan survey, many consumers indicated that they plan to reduce spending on non-essential items, and over 75% stated that they’ve recently been buying smaller quantities of products or delaying large purchases, actions indicating worsening economic conditions.

This declining optimism shouldn’t be surprising given that the balance sheets of lower- and middle-income consumers have begun to deteriorate. Debt service as a percentage of disposable income reached the lowest level in decades in the first quarter of 2021, largely because many consumers used Covid-19 stimulus checks to pay down their debt. However, once stimulus checks stopped arriving, credit card debt began to creep back upward. By mid-2024, debt service as a percentage of disposable income was already back near its 2019 level.2

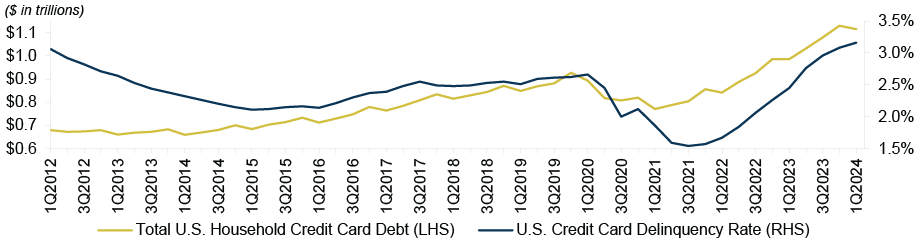

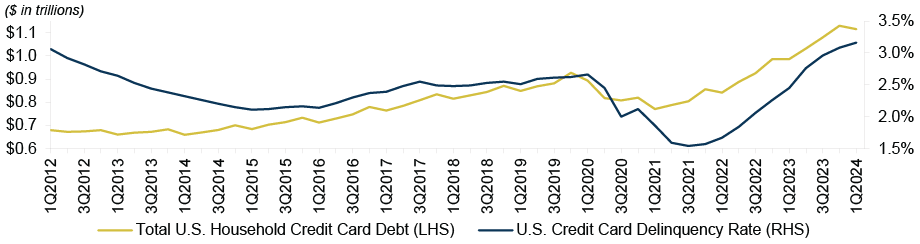

Credit card debt has risen to exceed $1 trillion,3 while credit card delinquencies have reached a level not seen since 2011. (See Figure 1.) At the same time, consumers are now saving less: the U.S. personal savings rate fell to 3.9% in May, less than half of the long-term average of 8.4% and well below the double-digit pandemic-era peaks.4

Figure 1: U.S. Credit Card Debt and Delinquencies Haven’t Been This High in Over a Decade

Source: Federal Reserve Bank of New York, as of March 2024

These mounting pressures are also reflected in sales at some retail businesses that cater to the middle and lower-middle classes. For example, in 1Q2024, midmarket chain Kohl’s significantly underperformed earnings expectations, and management indicated that pressure on the company’s middle-income consumer base was among the largest drivers of this underperformance.

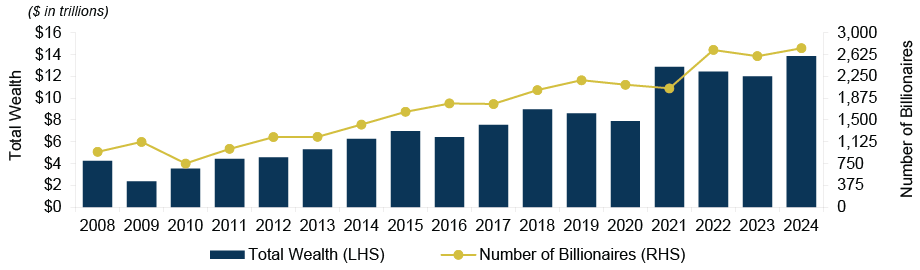

The situation is quite different for consumers in the highest income deciles. The trillions of dollars in monetary and fiscal stimulus released during the pandemic have created record-high levels of wealth for asset owners, especially the ultra-rich. In 2024, the number of billionaires globally reached the highest level on record, as their combined wealth exceeded $14 trillion.5 (See Figure 2.)

Figure 2: There Are More Billionaires Than Ever

Source: Forbes, as of April 2024

In a related trend, large U.S. companies are enjoying significant liquidity, with over $4 trillion of cash reserves in aggregate.6

(See Figure 3.) Technology giants such as Apple, Alphabet, and Microsoft are particularly prominent within this group; the three collectively hold more than 15% of the total cash on the books of companies in the S&P 500 Index.7 These excess cash holdings are enabling companies to buy back short-dated debt and increase share buybacks. In 2025, the latter are expected to exceed $1 trillion in the U.S. for the first time ever.8 If this increase in share buybacks materializes, it could be a meaningful catalyst for further equity market appreciation, which will only make economic bifurcation in the U.S. more pronounced.

Figure 3: U.S. Corporates Are Sitting on Large Cash Piles

Source: Bloomberg, as of March 2024

The Wall of Money

This significant concentration of wealth means that there is a surplus of capital in need of allocation. Consequently, wealthy individuals around the global have sought new investment opportunities in a variety of asset classes, including market segments once available only to the biggest institutional investors. For example, individual investors have increasingly been gaining access to private markets through business development companies (i.e., publicly registered funds that lend to small and middle-market businesses). BDCs’ assets under management grew by more than 20% year-over-year in 1Q2024 to eclipse $340 billion,9 and this massive increase in AUM was largely driven by the expansion of BDCs’ investor base from institutional to retail investors. Wealthy investors have also been allocating more capital to retail investment funds that offer exposure to private equity. Importantly, these trends aren’t likely to reverse any time soon: over 70% of wealth advisors in the U.S. anticipate increasing their clients’ allocation to alternative investments over the next five years.10

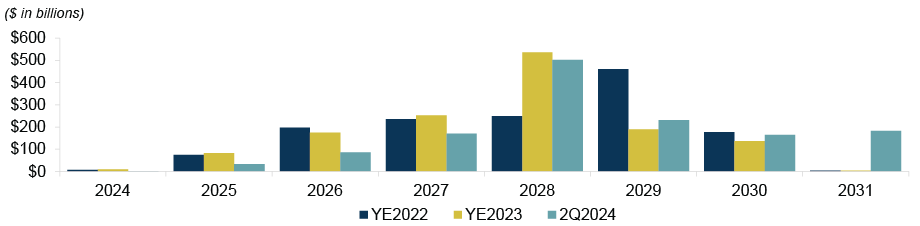

As a result of this surfeit of savings, heavily indebted companies have enjoyed far more liquidity than one would expect following a rapid increase in interest rates. Many below-investment grade companies have been able to extend maturities over the last year, especially companies that have issued in the loan market. At the end of last year, debt maturities in 2024-26 in the U.S. leveraged loan market stood at $268 billion. That number has since declined to $121 billion. (See Figure 4.) In fact, less than 9% of outstanding U.S. leveraged loans are now set to mature before 2026.11 Private credit has played a significant role in this trend, having refinanced roughly $20 billion of broadly syndicated loans in 2023.12

Figure 4: Maturities in U.S. Senior Loans Have Been Pushed Out

Source: PitchBook LCD, as of July 12, 2024

What Next?

Recent economic indicators suggest that struggles among middle- and lower-income consumers are beginning to intensify. Weekly initial jobless claims have spiked meaningfully in recent months, and unemployment levels in the U.S. have ticked up to 4.0%13 for the first time since 2021.

While declining inflation may enable the Fed to become slightly more dovish in the coming months, aggressive actions are unlikely at a time when capital market conditions are already quite accommodative. The Fed may want to provide some relief to consumers facing high prices and a softening labor market, but the Fed likely won’t want to do anything drastic (a) when it doesn’t need to (i.e., when unemployment remains relatively low) and (b) when access to financing has already become a lot easier for many businesses. While the Fed’s mandate doesn’t include popping equity market bubbles, the almost 20% YTD return for U.S. large-cap equities may give it pause, even if this rally has been driven by the performance of a few large companies.14

Ultimately, we believe we’ll continue to see conflicting economic and market signals for quite some time, so we think investors should remain patient before claiming “mission accomplished” on any front. That said, we believe that credit investors with limited legacy portfolio issues, capital to deploy, and a disciplined focus on diligent underwriting will be well positioned to earn attractive risk-adjusted returns in this complex market environment.

Credit Markets: Key Trends, Risks, and Opportunities to Monitor in 3Q2024

(1) The Spike in CLO Volumes Could Benefit CLO Equity Investors but Also Reduce Quality in the Loan Market

In the second quarter of 2024, CLO issuance hit record-high levels in both the U.S. and Europe. In the U.S., CLO issuance has reached $104.6 billion in the year to date, compared to $55.96 billion over the same period in 2023.15

Investor demand for CLO debt has soared in recent months primarily because CLOs offer much wider spreads than investment grade corporate bonds, while also appearing to offer a low risk of default. Demand has largely been driven by:

-

retail investors accessing the asset class via the CLO ETF market, which has doubled in size since the end of 2023 and now exceeds $12 billion;16

-

large amortizations among outstanding CLOs, which have returned an unprecedented $64 billion of capital to investors so far this year;17 and

-

sustained appetite from Japanese banks, which have historically made up the largest segment of CLO owners.

This elevated demand has caused CLO spreads to narrow drastically over the last 18 months. The spreads of AAA-rated CLO debt – the largest segment of a CLO – have recently contracted to roughly 150 basis points in the U.S., from a high of over 230 basis points in 4Q2022.18 This trend has created a very supportive technical environment for senior loans, as CLOs hold a majority of this market. This, in turn, has benefited CLO equity investors, as they profit when the cost of CLO liabilities (i.e., CLO debt tranches) declines relative to the value of CLO assets (i.e., the portfolio of senior loans).

Moving forward, the biggest obstacle in creating CLOs may be sourcing sufficient assets. While loan issuance has risen from the lows seen in 2022-23, the supply of new loans remains limited. Nearly 90% of U.S. loan issuance in 2Q2024 was related to refinancing or repricing activity, meaning the overall supply of loans hasn’t expanded meaningfully.19

Due to this constraint in loan supply, CLO managers who need to build their portfolios may be tempted to lower their credit underwriting standards. This could ultimately increase risk in the loan market, while generating opportunities for patient, disciplined investors with strong credit-picking skills.

(2) Markets Are Beginning to Price in a Less Dovish Interest Rate Environment

While it’s becoming increasingly likely that the Federal Reserve will soon cut interest rates, the Treasury yield curve is beginning to indicate that we may truly be in a new interest rate era.

The yield curve shifted upward during the second quarter, as the 10-year Treasury yield rose by 20 bps over the period to 4.4%. Additionally, at quarter-end, the market was only pricing in roughly 45 bps of interest rate cuts before year-end, down from almost 70 bps at the start of the quarter and the nearly 170 bps, or around seven 2024 cuts, reflected in the curve in mid-January.20 This less-dovish forecast is in line with the Fed’s “dot plot” of interest rate expectations that was released in June. It indicated that only one cut of around 25 bps is likely before year-end. The dot plot produced at the March meeting had suggested that we could see three cuts by December 31.

Meanwhile, at quarter-end, the yield curve also appeared to reflect mounting concerns about the size of the U.S. deficit. This concern is likely being exacerbated by the fact that none of the major candidates running for the U.S. presidency have made cutting the deficit a priority. The market seems particularly concerned about the inflationary potential of some of former President Donald Trump’s fiscal policies, as evidenced by the roughly 20 bps spike in the 10-year Treasury yield in the two days following President Joe Biden’s poor debate performance. This particular move was notable given that a lower-than-expected PCE inflation report was released on the day following the debate.

We believe this environment will create attractive opportunities for investors focused on income, but only if they can avoid the credit pitfalls.

(3) Banks Have Increasingly Been Able to Offload Risk

High cash reserves among U.S. corporations and elevated savings among consumers in high income deciles have helped to stabilize the U.S. banking sector after the ructions seen in early 2023. In the aftermath of the regional bank crisis, multiple U.S. banks sought to quickly increase liquidity, including through the use of synthetic risk transfers (SRT). Although liquidity conditions have improved since early 2023, U.S. banks’ use of SRTs is likely to continue growing, particularly now that the Federal Reserve has provided more guidance about banks’ ability to offload risk through these instruments.

In essence, an SRT is structured as follows:

-

A bank enters a contract with an investor, whereby the investor assumes the risk of future losses in a credit pool in exchange for receiving coupon income. This contract is a form of structured credit (i.e., a credit protection note).

-

The bank effectively removes their credit risk exposure, while avoiding having to sell any underlying assets, some of which may be trading at a discount.

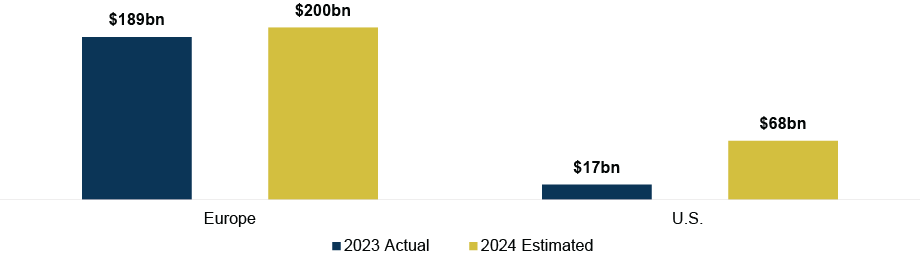

SRT has long been used in Europe, primarily because the stricter regulatory environment has forced banks to seek effective ways to raise regulatory capital. But the U.S. is likely to catch up quickly. It’s estimated that SRT issuance in the U.S. in 2024 will be roughly quadruple the 2023 levels, as the banking sector seeks to generate liquidity and free up capital. (See Figure 5.)

However, it’s important to note that SRT does not remove the underlying risk of bad loans; it’s just that the investor, not the bank, would bear the impact of defaults. Investors must carefully scrutinize the pool of assets to ensure that they are being adequately compensated for the risk.

Figure 5: SRT Is Expected to Grow Meaningfully in the U.S. in 2024

Source: Bank of America estimates, as of March 2024

Post Comment